Since 2016, authorized professionals have relied on Clio’s annual Authorized Developments Report for an neutral and complete evaluation of developments throughout the authorized discipline.

As essentially the most in depth evaluation of the authorized trade, the Authorized Developments Report compiles important information on regulation agency efficiency and identifies key elements driving modifications in authorized observe.

For attorneys in solo and small corporations, we provide specialised insights by our annual Authorized Developments for Solo and Small Legislation Companies report. We’re excited to announce the discharge of the 2024 Authorized Developments for Solo and Small Legislation Companies report, which examines these cohorts from varied views—together with efficiency developments, methods for enhancing cost collections, and attitudes in the direction of synthetic intelligence.

Beneath, we’ll current the important thing takeaways from this 12 months’s experiences—however make sure you discover the total 2024 Authorized Developments for Solo and Small Legislation Companies report for an in-depth overview of the developments shaping observe right now!

Solo and small corporations are capturing extra purchasers and income than ever, however solely having fun with modest positive factors in billable hours

Whereas solo and small corporations are opening extra new issues and billing and gathering greater than ever, this efficiency inside a bigger context signifies that solo and small corporations are solely making modest positive factors in general efficiency—and, in some circumstances, being outpaced by bigger corporations in efficiency areas beforehand dominated by solo and small corporations.

In comparison with 2016, solo and small regulation corporations have solely skilled minor development within the variety of billable hours captured by their staff. Small regulation corporations have captured over 8% extra billable hours than in 2016, whereas solo corporations have captured over 1% extra. Each solo and small corporations additionally look like experiencing a lower within the variety of billable hours captured in comparison with 2016. This efficiency trails considerably behind the expansion loved by bigger regulation corporations: since 2016, these corporations have captured practically 25% extra billable hours.

Regardless of the downward development in billable hours amongst solo and small corporations, the common attorneys in solo and small regulation corporations are literally billing and gathering greater than ever earlier than. Solo attorneys are billing over 75% extra and gathering over 80% greater than in 2016, whereas small agency attorneys are billing over 90% extra and gathering practically 100% greater than in 2016. Even when adjusting for inflation, solo corporations are billing 38% extra and gathering 42% extra, whereas small corporations are billing 49% extra and gathering 55% greater than in 2016.

However after we have a look at general key efficiency indicators, we aren’t seeing the identical ranges of enchancment.

Solo and small corporations wrestle with general realization and assortment efficiency

Since 2016, utilization charges (the share of time in an 8-hour workday that goes in the direction of billable work) have typically risen steadily for corporations of all sizes, suggesting that corporations are discovering simpler methods to streamline their workdays and put extra time towards billable work. These will increase are rather more distinguished amongst bigger corporations, who’ve persistently outperformed solo and small corporations and, as of 2023, get pleasure from common utilization charges which might be 10% increased than small corporations and 15% increased than solo corporations.

General, solo and small corporations have loved related general will increase of their realization charges (or the share of billable work that finally ends up on an bill) since 2016. Solos have managed to extend their realization charges by 9% since 2016 whereas small corporations have elevated their realization charges by 7%. Nonetheless, these enhancements are outperformed by the enhancements of bigger corporations, which have elevated their realization charges by 12% since 2016.

Lastly, since 2016, solo and small corporations have solely elevated their assortment charges (the share of invoiced work that will get paid by purchasers) by 4%. Bigger corporations haven’t fared a lot better—they’ve solely elevated their assortment charges by 5%. So, whereas corporations of all sizes are enhancing their assortment practices, it seems that they might not be absolutely realizing alternatives to extra effectively acquire cost from purchasers.

Some solo and small corporations face important struggles with lockup efficiency

Legislation corporations should pay shut consideration to how rapidly and persistently they’re getting paid. Far too many corporations discover their income held in “lockup”—the interval during which billable work has both not been invoiced or collected on.

Lockup consists of three parts (measured in days):

Realization lockup. That is the quantity of income that’s unbilled at any given time (also referred to as “work-in-progress lockup”).

Assortment lockup. That is the quantity of income that’s uncollected at any given time (also referred to as “debtor lockup”).

Complete lockup. This can be a mixture of income held in each realization and assortment lockup.

Many solo and small corporations face important challenges invoicing and gathering on excellent funds. Whereas the highest 25% of solo and small corporations typically outperform bigger corporations in terms of realization, assortment, and complete lockup, the underside 25% of solo and small corporations are inclined to carry out worse than bigger corporations—suggesting that many solo and small corporations are typically both excellent or very unhealthy at issuing payments and following up on excellent funds.

We additionally see that some Clio options are related to a big discount in lockup, together with Clio Funds, bulk billing, and Clio for Shoppers.

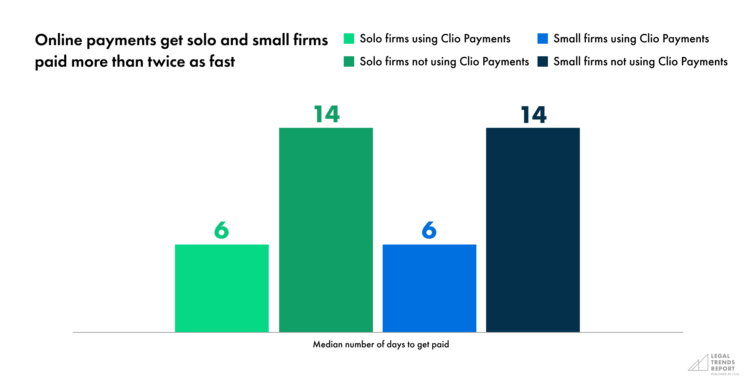

Solo and small corporations utilizing on-line funds receives a commission greater than twice as quick

The typical realization and assortment charges amongst solo and small corporations have been 86% and 90%, respectively.

Whereas these numbers look nice on their very own, we even have to have a look at what’s lacking—the 14% of billable hours that solo and small corporations aren’t invoicing to purchasers, or the ten% of billed quantities that aren’t being collected from purchasers. Right here, it turns into clear that solo and small corporations have great alternatives to enhance their realization and assortment charges.

Each solo and small agency attorneys report scuffling with their general workload, development, and the quantity of income their corporations herald. Moreover, many solo and small corporations seem to not offer the cost choices that their purchasers are searching for.

Providing on-line funds considerably reduces the friction concerned for purchasers in paying their authorized payments whereas serving to regulation corporations receives a commission sooner. This distinction is pronounced amongst solo and small corporations, which receives a commission greater than twice as quick when utilizing on-line funds. When wanting on the variety of days it takes to get payments paid, each solo and small corporations have a median ready interval of 6 days (in comparison with 14 days for these not utilizing on-line funds).

Legal professionals in solo and small corporations have related attitudes in the direction of AI use within the authorized career—however purchasers are much more captivated with it

Many attorneys (in corporations of all sizes) don’t consider that AI is superior sufficient to be thought of dependable. Regardless of these reservations, the overwhelming majority of attorneys consider that the potential advantages of AI outweigh the prices and practically one in 5 (19%) authorized professionals declare that they’re already utilizing AI in some kind of their practices.

Solo and small corporations are typically aligned of their views on AI: each cohorts intend to undertake AI know-how at a a lot sooner tempo than bigger corporations and intend to make use of AI to deal with routine administrative duties, together with cost and assortment duties. Nevertheless, purchasers look like much more captivated with the usage of AI within the authorized career than attorneys in solo and small corporations. Thirty-eight p.c of potential purchasers consider that attorneys who use AI-powered software program can provide extra reasonably priced companies than those that don’t (in comparison with 31% of attorneys in small corporations and 34% of solo attorneys), whereas 32% consider that attorneys can present higher-quality companies with AI software program (in comparison with solely 23% of small corporations and 19% of solo attorneys). In consequence, these corporations that embrace the transformative energy of AI might have a aggressive benefit as AI begins to get pleasure from extra widespread use.

The place does the information come from?

The Authorized Developments Report makes use of a variety of methodological approaches and information sources to ship the perfect insights in regards to the state of authorized observe and methods for future development.

Aggregated and anonymized Clio information

We’ve examined aggregated and anonymized information from tens of 1000’s of authorized professionals throughout the USA. This behavioral information affords precious insights into present know-how utilization amongst authorized professionals and its affect on agency efficiency.

Survey of authorized professionals

Between Might and July 2023, we performed a survey of 1,446 U.S. authorized professionals. The respondents included each attorneys and assist workers—corresponding to paralegals and directors—who’re concerned within the administration of their practices.

Survey of the final inhabitants

We surveyed 1,012 adults from the final U.S. inhabitants to grasp their attitudes, opinions, preferences, and behaviors relating to the authorized career. The respondents included people who’ve beforehand employed attorneys or might achieve this sooner or later. This pattern is consultant of the U.S. inhabitants when it comes to age, gender, area, earnings, and race/ethnicity, based mostly on the most recent U.S. census information.

Clio’s funding in solo and small corporations

Clio is devoted to supporting solo and small regulation corporations by offering them with the instruments and assets they want to achieve right now’s authorized atmosphere. We provide a complete suite of options designed to streamline processes, improve effectivity, and allow distinctive shopper service, all with the flexibleness to work from anyplace.

Our options cowl important areas corresponding to time-tracking, billing, doc administration, shopper communications, and shopper consumption, liberating up time for solo and small corporations with restricted assets to stay aggressive and develop. And, by investing in synthetic intelligence by options like our forthcoming AI providing, Clio Duo, we’re additional streamlining routine duties for solo and small corporations by the ability of automation.

We consider the success of solo and small regulation corporations is essential for the authorized trade’s well being and accessibility. By equipping these corporations with modern instruments and strong assist, Clio helps to create a extra environment friendly, client-centered authorized panorama.

To be taught extra, watch how solo and small corporations use Clio with our free, on-demand webinar.

What’s a solo observe of regulation?

A solo observe of regulation is a authorized observe run by a single legal professional with out companions or associates. This solo practitioner handles all elements of the enterprise, together with shopper consultations, case administration, and administrative duties, providing customized and versatile authorized companies.

What dimension is a small regulation agency?

A small regulation agency sometimes consists of two to 4 authorized professionals. These corporations provide a extra customized strategy in comparison with bigger corporations and infrequently present a variety of authorized companies whereas sustaining shut shopper relationships and versatile working environments.

Is it higher to work at a small regulation agency or an enormous regulation agency?

Whether or not it’s higher to work at a small or large regulation agency is dependent upon your preferences and profession targets. Small corporations provide close-knit environments, diverse work, and suppleness, whereas large corporations present increased salaries, specialised observe areas, and extra in depth assets and coaching alternatives.

We revealed this weblog submit in June 2024. Final up to date: June 18, 2024.

Categorized in:

Clio

![CfP: Indian Journal of Integrated Research in Law [Vol 5, Issue 4, PIF: 6.962, ISSN: 2583-0538, Peer Reviewed Journal, Indexed at MANUPATRA, HeinOnline, Google Scholar & ROAD, Hard Copy, DOI, Certificate of Excellence, Editorial & Internship Opportunities]: Submit by July 29!](https://i3.wp.com/cdn.lawctopus.com/wp-content/uploads/2025/02/IJIRL-logo-2.png?w=350&resize=350,250&ssl=1)

![CfP: Indian Journal of Integrated Research in Law [Vol 5, Issue 4, PIF: 6.962, ISSN: 2583-0538, Peer Reviewed Journal, Indexed at MANUPATRA, HeinOnline, Google Scholar & ROAD, Hard Copy, DOI, Certificate of Excellence, Editorial & Internship Opportunities]: Submit by July 29!](https://i3.wp.com/cdn.lawctopus.com/wp-content/uploads/2025/02/IJIRL-logo-2.png?w=120&resize=120,86&ssl=1)